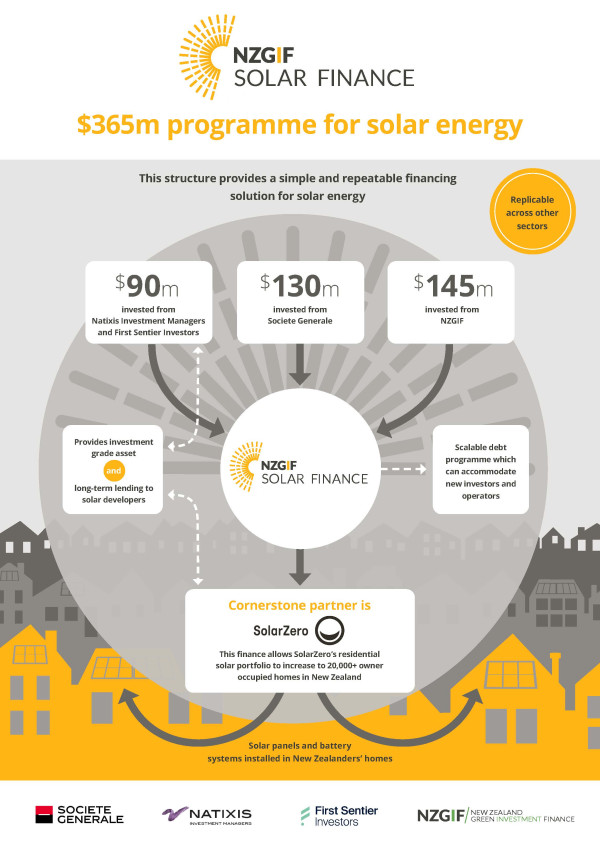

New Zealand Green Investment Finance (NZGIF) has led a second debt issuance, making a total of $365m (NZD) available for medium to long term debt to solar providers.

In addition to $90m of private sector debt sourced in September 2023 from First Sentier Investors and Natixis Investment Managers, Societe Generale has now financed a further $130m of available debt into NZGIF’s Solar Finance programme. NZGIF has invested $145m into the programme (1).

The new solar lending will further finance Aotearoa New Zealand’s largest residential PPA (Power Purchase Agreement) portfolio, managed by SolarZero. The total lending will help provide access to affordable renewable generation for 20,000+ New Zealand households.

Video

Watch as Jason Patrick (NZGIF, Chief Investment Officer) and Arkady Lippa (Societe Generale, Co-Head of Securitisation & Fund Financing for Asia Pacific) discuss the future of Solar Finance and why New Zealand is a great place to invest.

Video

Watch as Jason Patrick (NZGIF, Chief Investment Officer) and Arkady Lippa (Societe Generale, Co-Head of Securitisation & Fund Financing for Asia Pacific) discuss how important Solar Energy is to decarbonisation and how NZGIF Solar Finance assists solar operators.

Solar Finance is a solution structured for growth

NZGIF Solar Finance is meeting its objective of becoming a simple and repeatable financing solution for solar energy. The scalable nature of the programme can accommodate new investors and new operators.

“NZGIF Solar Finance is structured for growth. Private capital provides the scale that’s needed to accelerate investment into decarbonisation,” says Jason Patrick, Chief Investment Officer, NZGIF.

“Having the support of a major European bank like Societe Generale is significant and welcomed. Societe Generale, First Sentier Investors and Natixis Investment Managers all see value in New Zealand’s renewable energy sector. Our opportunity is to now harness this type of financial support, from domestic and offshore investors, towards other sectors and additional partners, capable of reducing New Zealand’s carbon emissions,” Patrick adds.

“NZGIF Solar Finance is the first programme of its kind in Australasia, and it represents an excellent investment opportunity for New Zealand. We are pleased to leverage our innovative financing solutions and support New Zealand’s energy transition as part of Societe Generale’s long-term commitment to decarbonisation,” says Arkady Lippa, Co-Head of Securitisation & Fund Financing for Asia Pacific at Societe Generale.

Solar energy's role in our future energy requirements

Solar energy has a crucial role to play in New Zealand’s future energy requirements.

Matt Ward, SolarZero CEO, says, “Our electricity demand is going to increase by 50-60% by 2050. Solar is the cheapest form of generation on the planet right now, so it's only logical that solar plays a part in that.”

Solar energy currently makes up around 1% of New Zealand’s delivered electricity. Transpower predicted in 2020 that this would rise to 13% of New Zealand’s delivered electricity by 2050 under a scenario where electrification of the economy is accelerated. (2)

The distributed nature of rooftop solar energy, like that provided by Solar Zero, is important for community resilience also. This was proven in the recent potential grid emergency issued on 10 May.

“So, on the 10th of May, for instance, when New Zealand had its grid energy crisis, SolarZero deployed 30 megawatts of power and effectively helped keep the lights on,” says Ward.

Each partner in this programme has a role

NZGIF Solar Finance bridges the gap between market needs. Solar operators need long term fixed rate debt as well as warehousing debt facilities, and existing funders have been cautious about financing the more disruptive and innovative participants in the sector.

“We took a bundle of residential solar assets and solar contracts and were able to structure them for investors in this programme. Under attractive criteria and standardised terms, we created an opportunity that has brought in offshore investors looking for a long-term investment,” says Patrick.

“New Zealand is a strong jurisdiction from a credit perspective, with clear government policy and public investment entity support. This programme is also a testament to what NZGIF is good at designing and putting together. NZGIF’s involvement has been pivotal in securing this financing. We are honoured to have contributed to this public private collaboration,” says Lippa.

Ward adds, “We need alternative funding models and capital models to do that. We need to solve the energy trilemma for Kiwis, i.e. decarbonise the economy, make sure energy is reliable so there's no blackouts, and make sure it's affordable. We couldn’t do it without NZGIF, First Sentier Investors, Natixis Investment Managers and Societe Generale.”

Diagram

Diagram: How NZGIF Solar Finance works.

Video

Watch as NZGIF's Waruna Karunaratne and Corbin Constantine and SolarZero CEO Matt Ward explain the significance of this deal.

About NZGIF

New Zealand Green Investment Finance is a green investment bank established to facilitate and accelerate investment that can help to reduce greenhouse gas emissions in New Zealand. With $700 million of investment capital, it is now one of the largest direct investors for climate change in Aotearoa New Zealand.

NZGIF is a long-term, mission-driven investor, providing innovative, flexible and tailored capital solutions to support decarbonisation initiatives across a broad range of sectors. It invests in scalable companies, technologies and products that are commercial-ready and offer low carbon benefits for New Zealand. As a limited liability company independent of government, NZGIF makes independent investment decisions. It invests on a commercial basis and does not offer concessionary finance. NZGIF is not a registered bank. For more, see www.nzgif.co.nz

About Societe Generale

Societe Generale is a top tier European Bank with more than 126,000 employees serving about 25 million clients in 65 countries across the world. We have been supporting the development of our economies for 160 years, providing our corporate, institutional, and individual clients with a wide array of value-added advisory and financial solutions. Our long-lasting and trusted relationships with the clients, our cutting-edge expertise, our unique innovation, our ESG capabilities and leading franchises are part of our DNA and serve our most essential objective - to deliver sustainable value creation for all our stakeholders. For more information, you can follow us on Twitter/X @societegenerale or visit our website societegenerale.com.

About First Sentier Investors

First Sentier Investors is a global asset management group providing high quality, differentiated and relevant investment capabilities to deliver exceptional investment performance for our clients. Today, across the First Sentier Investors Group, we manage A$226.8 billion (3) in assets across global and regional equities, cash and regional fixed income, infrastructure and property, and alternative credit. We are home to investment teams and brands such as AlbaCore Capital Group, FSSA Investment Managers, Igneo Infrastructure Partners, RQI Investors, and Stewart Investors. All investment teams operate with discrete investment autonomy, according to their investment philosophies and based on responsible investment principles.

Our organisation was acquired by Mitsubishi UFJ Trust and Banking Corporation, a wholly owned subsidiary of Mitsubishi UFJ Financial Group, Inc in August 2019. We operate as a standalone global investment management business with offices across Europe, the Americas, and Asia Pacific. We are a globally Certified B Corporation and signatory to the UK Stewardship Code.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers (4) with more than $1.2 trillion assets under management (5) (€1.1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments; (6) Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

About SolarZero

SolarZero is New Zealand’s largest provider of household solar energy systems, helping more Kiwis make the switch to solar and save on their power bill in the process. Established in 2008 by Andy Booth, SolarZero has evolved to become New Zealand’s leading solar energy business with offices in Christchurch, Nelson and Auckland. With SolarZero panels and batteries, customers enjoy lower energy costs, and can access stored power when the sun isn’t shining or in a power cut. SolarZero is passionate about accelerating New Zealand’s transition to be 100% renewable and lower the cost of energy for all Kiwis. Visit solarzero.co.nz for more.

Notes

(1) See diagram above.

(2) TP Whakamana i Te Mauri Hiko.pdf (transpower.co.nz)

(3) First Sentier Investors’ gross AUM, inclusive of associated strategic partnership with AlbaCore Capital Group, as of 30 June 2024.

(4) Cerulli Quantitative Update: Global Markets 2023 ranked Natixis Investment Managers as the 17th largest asset manager in the world based on assets under management as of December 31, 2022.

(5) Assets under management (“AUM”) of current affiliated entities measured as of June 30, 2023, are $1,288.6. billion. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

(6) A brand of DNCA Finance.